Two major reasons to not use online car insurers

Samuel Cise • 4 February 2023

Online insurers - buy cheap, buy _____

Online insurers seem to be the first port of call for anyone who hasn't quite experienced the service and product you get from a Private Client Insurance Broker.

There are important reasons why you cannot buy some insurance policies online.

Firstly, price. Yep cheap and cheerful is a thing in Insurance - buy cheap, buy twice - what this actually means is your claim isn't paid so you may buy twice but it is too late by then, your claim isn't covered or you don't get paid anywhere close to what you expected.

Secondly, exclusivity. When you get to a certain level a broker is always required to advise you on what best suits you. Impartial advice is needed especially with our exclusive policies only available via a broker which are more comprehensive and include many perks that suit a HNW individuals lifestyle. This makes for stress free driving, what everyone wants when they own a luxury or sports car.

But this article isn't to educate you on the differences between online insurers and the policies only available via brokers its to highlight the comments and review online insurers receive which if you're considering buying insurance online you should use to aide your decision making.

However let's just list out some of the major benefits to a Private Client broker-only policy that you do not get with online insurers:

Agreed Value

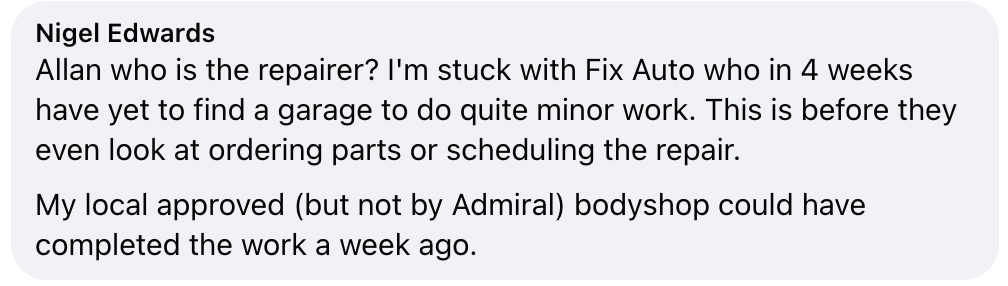

Choice of repairer

Multi car discount

New car replacement up to 3 years

Driving other cars comprehensively

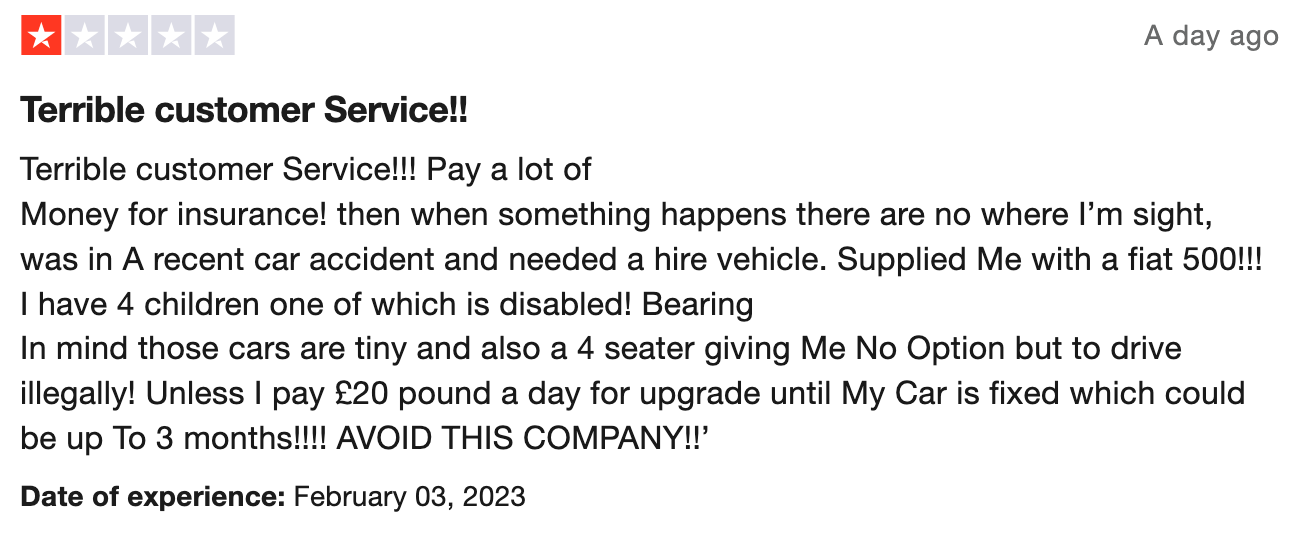

Like for like courtesy car

I'm going to dive deeper on two benefits and give some examples of what an online insurer would do.

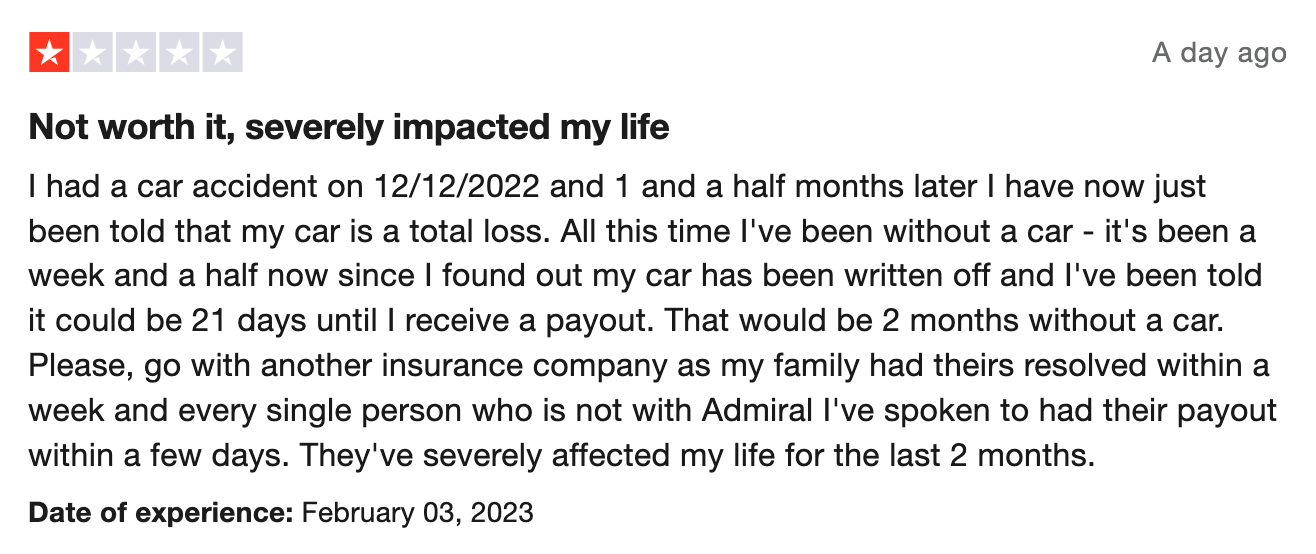

Agreed Value - your car is worth £100,000, either you paid that amount or its the current value either way with an Agreed Value policy if an incident happens say theft or write off you get £100,000 (less an excess) on day 1 or day 364.

vs

Market Value - Online insurers do not do Agreed Value they have Market Value cover. Same incident happens now you enter negotiations, do you think they'll give you £100,000 no quibbles? Do you think it's now you vs them to determine the value? Do you think their value will differ to yours? When the negotiations end you'll get what you're given and have no say in it regardless of the condition or low mileage. Most likely sub £90,000. That £300 you saved on a Market Value policy vs an Agreed Value policy via Private Client broker no longer seems significant!

Choice of repairer - our policies give you the complete choice and flexibility on where you take your car in the event of it being damaged. Own a Ferrari and want Ferrari's own bodyshop to do the work? No problem, agreed. Got a long term friend who's always worked on your cars and owns his own bodyshop? No problem, agreed. Easy right.

vs

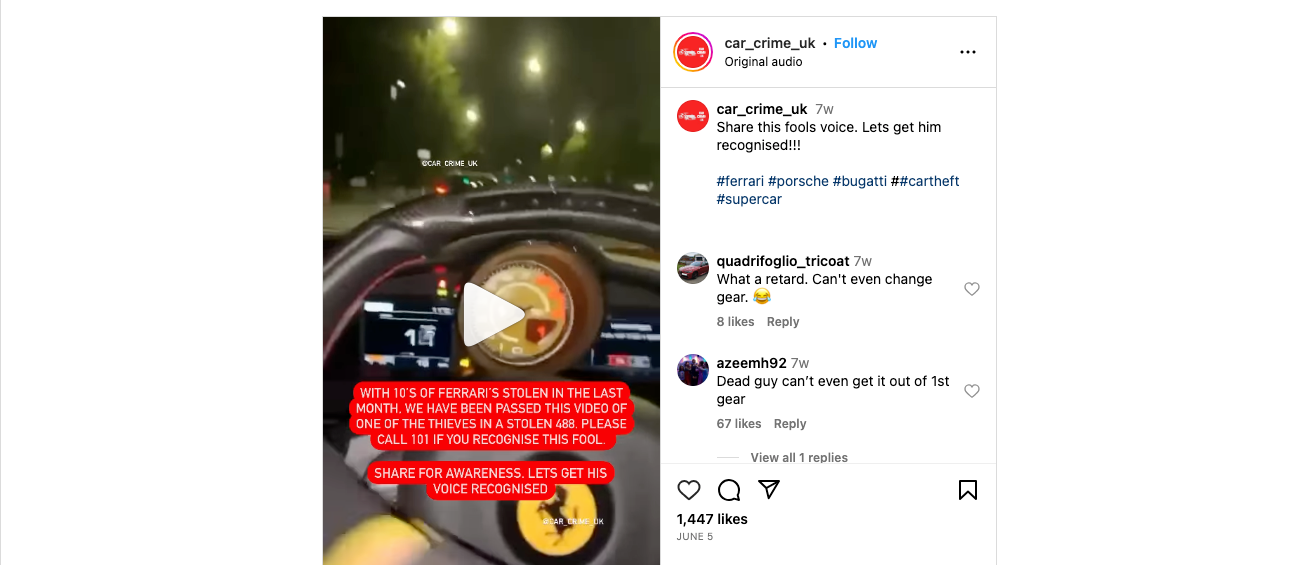

Approved Repairer - with online car insurance policies you do not have this choice, your car goes to wherever you're told. No courtesy car, not their problem. Long wait times for parts, not their problem. Poor workmanship, your problem! Let's use the same example car, a Ferrari (yes some people insure their pride and joys with online insurers without Agreed Value) will go to whatever bodyshop is within the network for the insurer, in other words ones they've done deals with for cheap labour. Cheap labour means top quality results? We all know that isn't true. Are you happy your car going to a repairer you cannot chose?

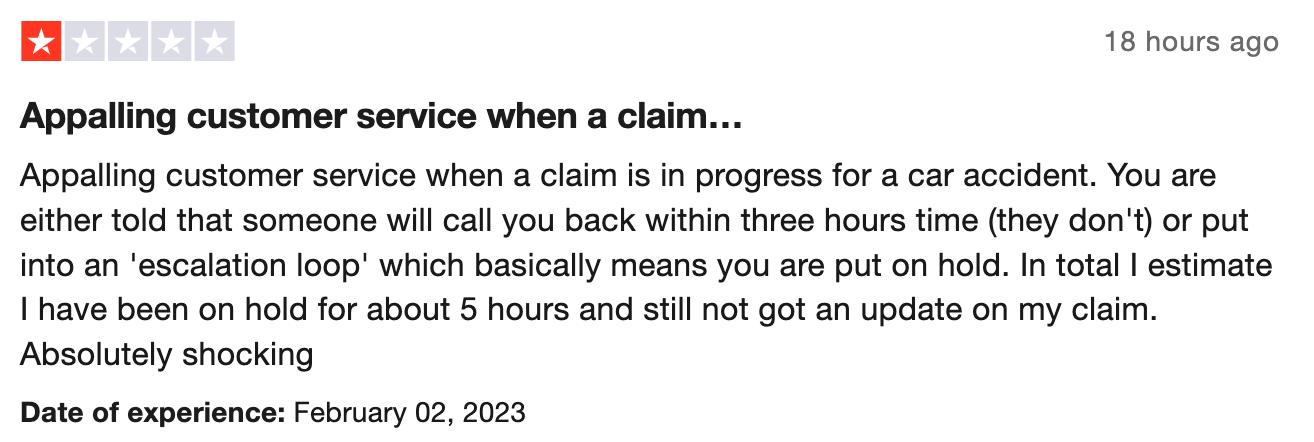

I haven't even mentioned Call Waiting Times - I will save this for another time but please do one thing, call us and then call an online insurer at 10am and 10pm, see who answers faster!

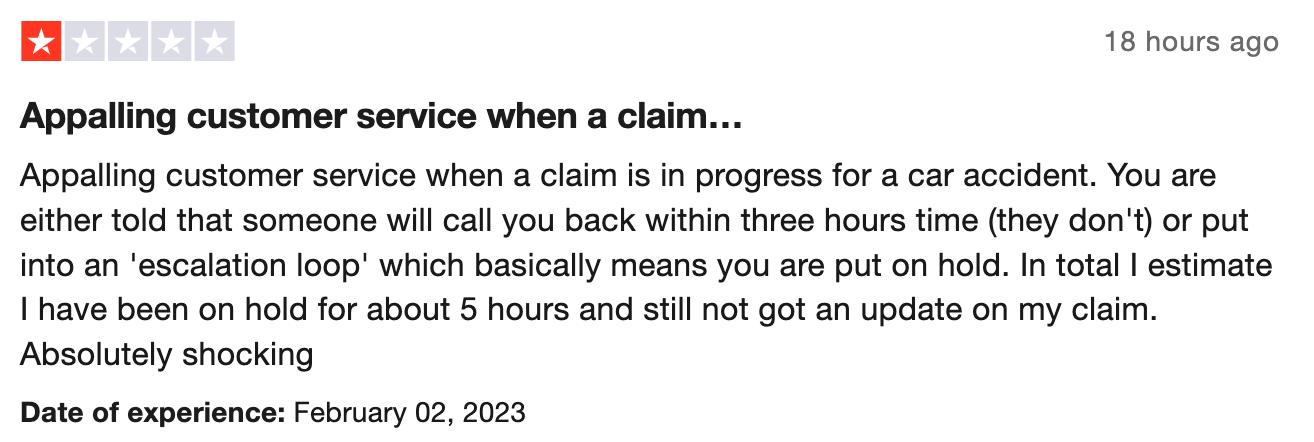

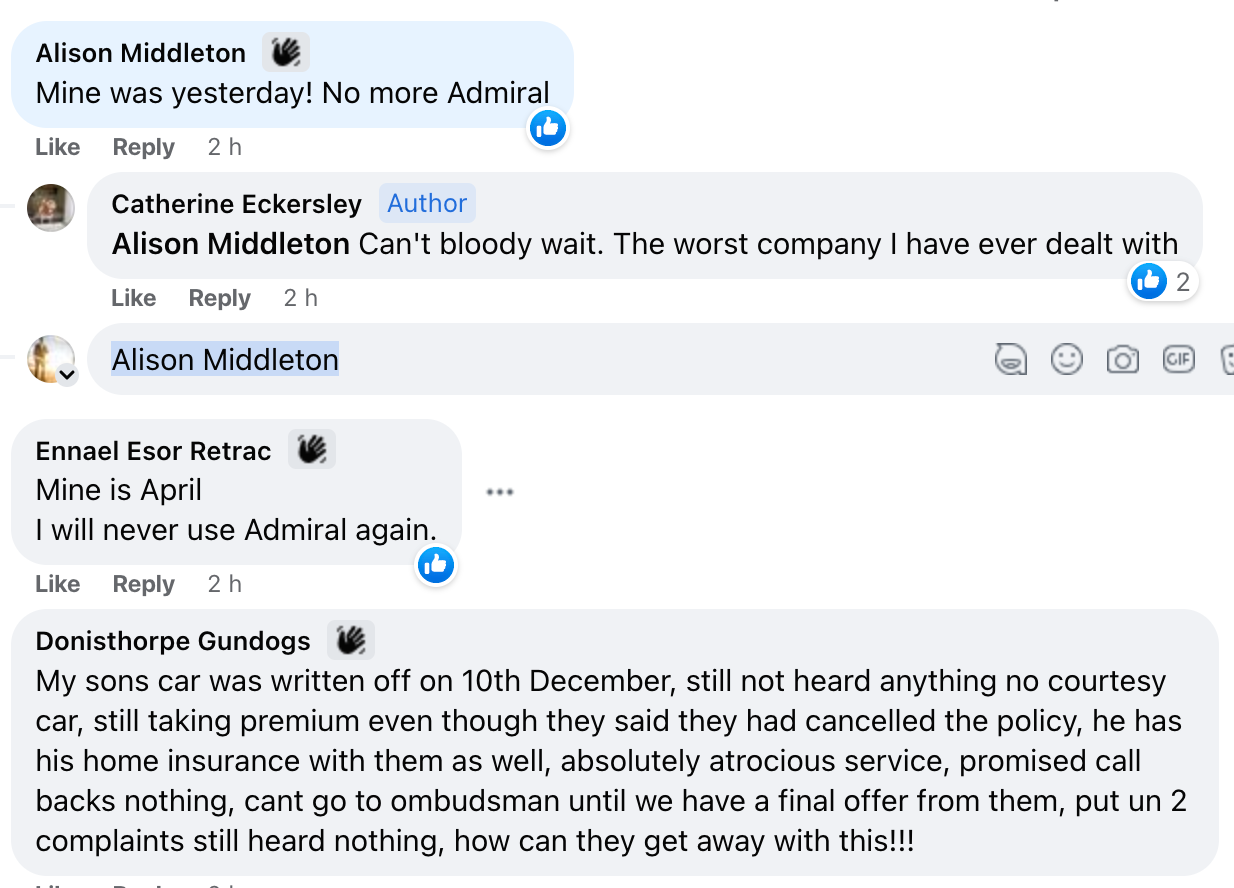

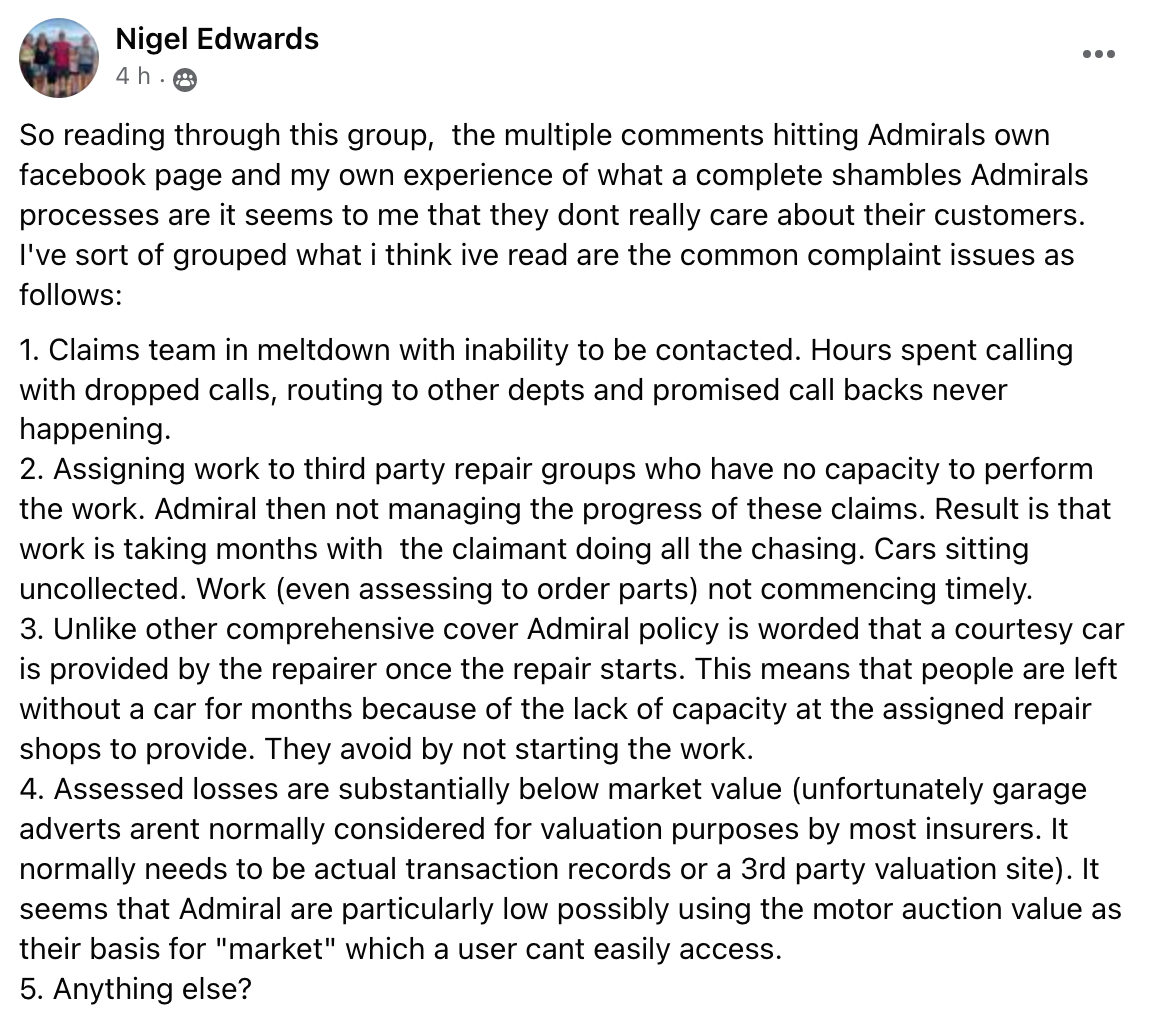

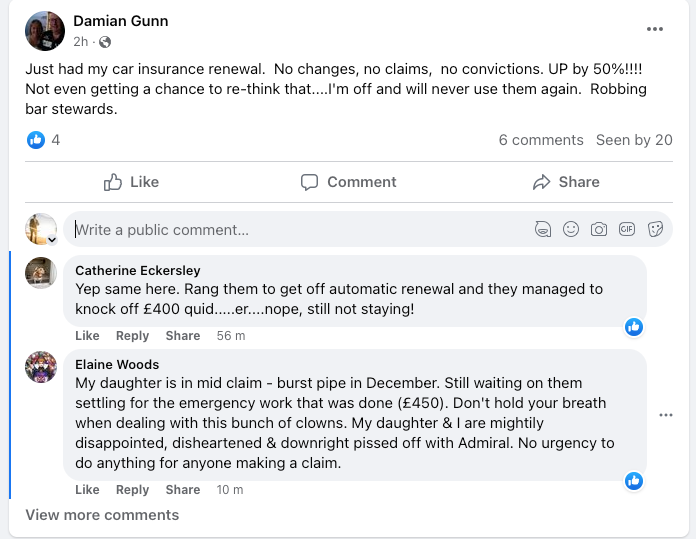

For good measure, below are some comments and reviews from some randomly chosen online insurers.

Samuel Cise

Managing Director

Saxon Insurance Brokers

0203 384 0303